Understanding your finances is crucial for any business. Financial Fusion offers AI-powered insights to simplify this process.

Financial Fusion transforms complex financial data into clear, actionable items. It integrates with popular tools like QuickBooks and Excel, providing real-time updates and customizable reports. This tool offers many benefits, such as deeper financial clarity and enhanced decision-making. By visualizing trends and generating impactful reports, businesses can save time and make more informed decisions.

Financial Fusion is designed to streamline financial management, making it accessible and efficient for any company. This blog will explore the various benefits of using Financial Fusion, helping you understand how it can improve your business’s financial health.

Credit: www.linkedin.com

Introduction To Financial Fusion

In today’s fast-paced financial world, businesses need tools that can simplify complex data. Financial Fusion is an AI-powered solution designed to transform financial data into clear, actionable items. By integrating with popular accounting tools, it offers real-time insights and customizable reports that help businesses make informed decisions.

What Is Financial Fusion?

Financial Fusion is an intuitive financial tool powered by AI. It provides intelligent financial insights that streamline decision-making. This tool integrates seamlessly with popular accounting platforms like QuickBooks, Xero, Zoho, and Excel. It aims to offer real-time updates and tailor-made reports to highlight key financial metrics.

The Purpose Of Financial Fusion In Today’s Market

Financial Fusion serves a crucial role in today’s market by offering several benefits:

- Deeper Financial Clarity: Precision-driven analytics provide a clearer understanding of financial data.

- Instant Visualization: Users can visualize trends and insights instantly.

- Enhanced Decision-Making: Real-time updates enhance the decision-making process.

- Seamless Data Integration: Integrating data sources smoothly saves time and effort.

- Impactful Reporting: Generating customizable reports with ease helps in better financial planning.

These features make Financial Fusion a valuable tool for any business looking to improve its financial management and decision-making processes.

| License Tier | Price | Features |

|---|---|---|

| License Tier 1 | $29 | Basic features and reports for 1 company |

| License Tier 2 | $99 | Detailed reports, balance sheet, quarterly and yearly reviews for 1 company |

| License Tier 3 | $199 | Features of Tier 2 for up to 5 companies |

With a 60-day money-back guarantee, businesses can try Financial Fusion risk-free. The lifetime access with a one-time payment ensures continuous updates without additional costs.

Key Features Of Financial Fusion

Financial Fusion is an AI-powered tool designed to simplify financial management. This tool provides valuable insights, streamlines decision-making, and integrates seamlessly with popular accounting software. Below are the key features that make Financial Fusion a powerful asset for any business.

Integrated Financial Management

Financial Fusion integrates all your financial data into a single platform. This integration makes it easier to manage finances without switching between multiple tools.

- Seamless integration with QuickBooks, Xero, Zoho, and Excel.

- Centralized financial management for better control and visibility.

Real-time Data Synchronization

Real-time data synchronization ensures that your financial information is always up-to-date. This feature enables timely decision-making and accurate financial tracking.

- Instant updates from integrated accounting tools.

- Reduces the risk of errors with real-time data.

Advanced Analytics And Reporting

Financial Fusion offers advanced analytics and customizable reports. These reports highlight key metrics and trends, providing valuable insights for informed decision-making.

| Feature | Description |

|---|---|

| AI-Powered Insights | Intelligent analysis of financial data for better decisions. |

| Customizable Reporting | Create tailored reports to suit your business needs. |

Customizable Financial Solutions

Financial Fusion offers customizable solutions to fit your business requirements. This flexibility ensures that the tool adapts to your specific financial needs.

- Create personalized financial reports.

- Adjust features based on company size and scope.

With its array of features, Financial Fusion provides a comprehensive solution for managing finances efficiently.

Benefits Of Financial Fusion For Businesses

Financial Fusion offers significant advantages for businesses, making financial management more efficient and effective. This AI-powered tool transforms complex financial data into clear and actionable insights. Below, we explore the key benefits.

Enhanced Decision-making Capabilities

Financial Fusion provides AI-powered insights that help businesses make better decisions. The tool offers real-time updates and customizable reports, enabling leaders to visualize trends and insights instantly. This leads to more informed and strategic decision-making.

Streamlined Financial Operations

With seamless integrations to popular accounting tools like QuickBooks, Xero, Zoho, and Excel, Financial Fusion ensures smooth data flow. This integration saves time and reduces manual work, allowing businesses to focus on core activities.

Increased Efficiency And Productivity

By consolidating financial data from various sources, Financial Fusion enhances efficiency. Users can generate impactful reports with ease, which increases productivity. The tool’s ability to provide real-time updates helps in staying ahead of financial challenges.

Improved Financial Accuracy And Compliance

Financial Fusion’s precision-driven analytics ensure deeper financial clarity. This accuracy helps businesses maintain compliance with financial regulations. The customizable reporting feature highlights key metrics, reducing errors and improving overall financial health.

| Feature | Benefit |

|---|---|

| AI-Powered Insights | Better decision-making |

| Customizable Reporting | Highlights key metrics |

| Seamless Integrations | Saves time |

| Real-Time Updates | Visualize trends instantly |

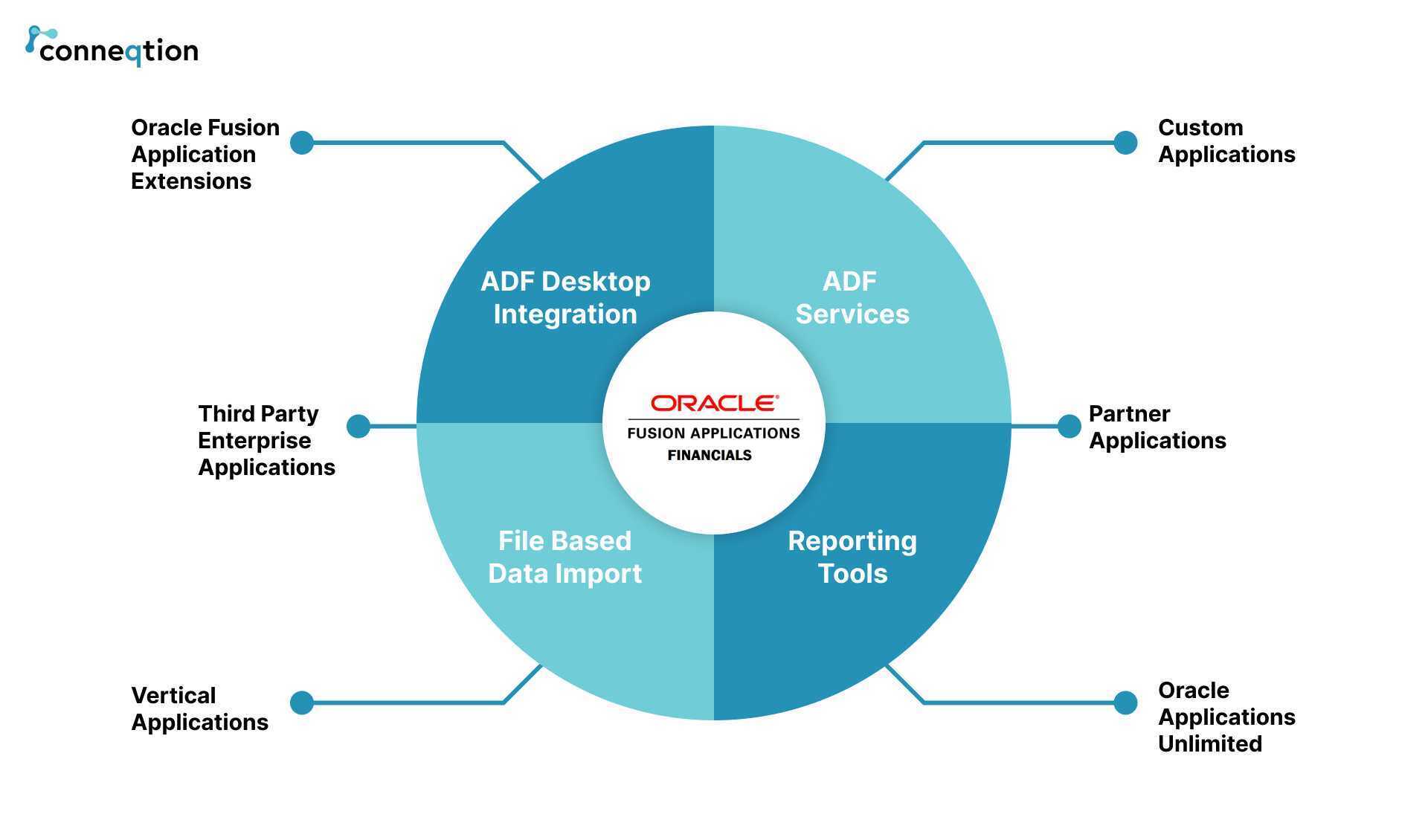

Credit: conneqtiongroup.com

Pricing And Affordability Of Financial Fusion

Financial Fusion offers a robust AI-powered financial tool that integrates seamlessly with popular accounting platforms. It provides real-time updates, customizable reports, and intelligent financial insights to enhance decision-making. But how does it fare in terms of pricing and affordability? Let’s delve into the specifics.

Cost Breakdown Of Financial Fusion

Financial Fusion offers three distinct pricing tiers to cater to various business needs. Each tier involves a one-time payment, ensuring lifetime access with continuous updates and improvements.

| License Tier | Price | Features |

|---|---|---|

| License Tier 1 | $29 | Basic features and reports for 1 company |

| License Tier 2 | $99 | Detailed reports, balance sheet, quarterly and yearly reviews for 1 company |

| License Tier 3 | $199 | Features of Tier 2 for up to 5 companies |

Each tier provides a 60-day money-back guarantee, allowing users to try the product for 2 months and request a refund if not satisfied.

Comparing Financial Fusion To Competitors

When comparing Financial Fusion to other financial tools, it stands out with its one-time payment model. Most competitors require monthly or annual subscriptions, adding up to higher long-term costs.

- Financial Fusion: One-time payment, lifetime access

- Competitor A: Monthly subscription of $30

- Competitor B: Annual subscription of $300

The seamless integration with popular tools like QuickBooks and Xero, combined with real-time updates and AI-powered insights, provides a significant edge.

Value For Money: Is It Worth The Investment?

Financial Fusion offers exceptional value for money. For a one-time fee, users gain access to powerful financial insights, customizable reports, and seamless integrations. This eliminates the recurring costs associated with subscription-based models.

- Save time by integrating all your data sources smoothly.

- Enhance decision-making with real-time updates.

- Generate impactful reports with ease.

Financial Fusion’s pricing structure ensures that businesses, regardless of size, can benefit from advanced financial tools without breaking the bank. The combination of AI-powered insights and lifetime access makes it a worthwhile investment.

Pros And Cons Of Financial Fusion

Financial Fusion is an AI-powered financial tool that transforms complex financial data into clear, actionable insights. While it offers numerous advantages, it’s essential to consider both the benefits and the potential drawbacks before making a decision.

Advantages Of Using Financial Fusion

- AI-Powered Insights: Financial Fusion provides intelligent financial insights, enabling better decision-making.

- Customizable Reporting: Users can create tailored reports that highlight key metrics specific to their needs.

- Seamless Integrations: The tool syncs effortlessly with popular accounting platforms like QuickBooks, Xero, Zoho, and Excel.

- Real-Time Updates: Financial Fusion offers real-time updates, ensuring that users always have the latest financial data.

- Time-Saving: By integrating all data sources smoothly, it saves time and simplifies financial management.

- Impactful Reports: Users can generate reports that provide deeper financial clarity and precision-driven analytics.

Potential Drawbacks And Limitations

- Cost: The one-time payment might be high for small businesses, especially for License Tier 3.

- Learning Curve: While the tool is powerful, it might take some time for users to fully understand and utilize all features.

- Integration Issues: Although it integrates with popular tools, there might be occasional sync problems that need troubleshooting.

- Feature Overload: Some users might find the range of features overwhelming and may not use the tool to its full potential.

Credit: cloudfoundation.com

Recommendations For Ideal Users

Financial Fusion is an AI-powered financial tool that simplifies complex financial data. It is perfect for businesses aiming to enhance financial decision-making. The tool integrates with popular accounting systems, offering real-time updates and customizable reports. Below are specific recommendations for ideal users of Financial Fusion.

Businesses That Benefit The Most From Financial Fusion

Financial Fusion is designed to cater to a variety of businesses. Here are some that benefit the most:

- Small and Medium Enterprises (SMEs): These businesses often lack dedicated financial analysts. Financial Fusion provides them with precise financial insights.

- Startups: Startups need to make quick and informed financial decisions. The tool offers real-time updates and visualizations to aid their growth.

- Freelancers and Consultants: With customizable reports, freelancers and consultants can easily track their finances and generate impactful reports for clients.

- Accounting Firms: Firms managing multiple clients will find the seamless integrations and detailed reports highly beneficial.

Scenarios Where Financial Fusion Is Particularly Effective

Financial Fusion excels in various scenarios, enhancing financial clarity and decision-making:

- Monthly Financial Reviews: The tool offers precise analytics and customizable reports, making it easier to review monthly financial performance.

- Budget Planning: Businesses can visualize trends and insights to plan their budgets more effectively.

- Tax Preparation: The seamless integration with accounting tools like QuickBooks and Xero simplifies tax preparation.

- Client Reporting: Freelancers and consultants can generate detailed reports for their clients, improving transparency and communication.

| License Tier | Features | Price |

|---|---|---|

| License Tier 1 | Basic features and reports for 1 company | $29 |

| License Tier 2 | Detailed reports, balance sheet, quarterly and yearly reviews for 1 company | $99 |

| License Tier 3 | Features of Tier 2 for up to 5 companies | $199 |

Financial Fusion offers a 60-day money-back guarantee, ensuring users can try the product risk-free. With a one-time payment, businesses get lifetime access and continuous updates, making it a valuable investment.

Frequently Asked Questions of Financial Fusion Benefits

What Is Financial Fusion?

Financial Fusion is the integration of various financial services and tools. It aims to streamline financial management for individuals and businesses.

How Does Financial Fusion Work?

Financial Fusion works by combining different financial services into a single platform. This allows for easier access and management of financial activities.

What Are The Benefits Of Financial Fusion?

Financial Fusion offers numerous benefits including time savings, improved financial planning, and consolidated financial information. It also enhances financial decision-making.

Who Can Benefit From Financial Fusion?

Both individuals and businesses can benefit from Financial Fusion. It simplifies financial management and provides valuable insights for better financial decisions.

Conclusion

Financial Fusion simplifies your financial management with ease and efficiency. Its AI-driven insights make decision-making straightforward. The seamless integration with popular accounting tools saves time and effort. Customizable reports provide vital metrics at a glance. The tool’s real-time updates keep you informed and ready.

Financial Fusion truly enhances financial clarity. Try it risk-free with the 60-day money-back guarantee. For more details, visit [Financial Fusion](https://appsumo. com/products/financial-fusion/).