In a world where everything seems to be shifting to the cloud, it’s easy to overlook the benefits of non-cloud-based accounting software. But hold on! There’s a whole universe of accounting solutions that don’t rely on the Internet, and they’re packed with features that can help businesses of all sizes manage their finances more effectively. Accounting is a small business owner, a freelancer, or part of a larger organization, non-cloud-based accounting software can provide you with the control, security, and functionality you need to thrive.

Accounting your financial data securely stored on your own hardware, free from the risks of internet outages or data breaches. Sounds appealing, right? Let’s explore the exciting world of non-cloud-based accounting software, why you should consider it, and the best options available in 2025!

Source: medium.com

What is Non-Cloud Based Accounting Software?

Non-cloud-based accounting software refers to applications that are installed locally on a computer or server rather than being hosted on the Internet. This type of software allows users to manage their accounting tasks without relying on an internet connection. It’s particularly beneficial for businesses that prioritize data security, have limited internet access, or prefer to maintain complete control over their financial information.

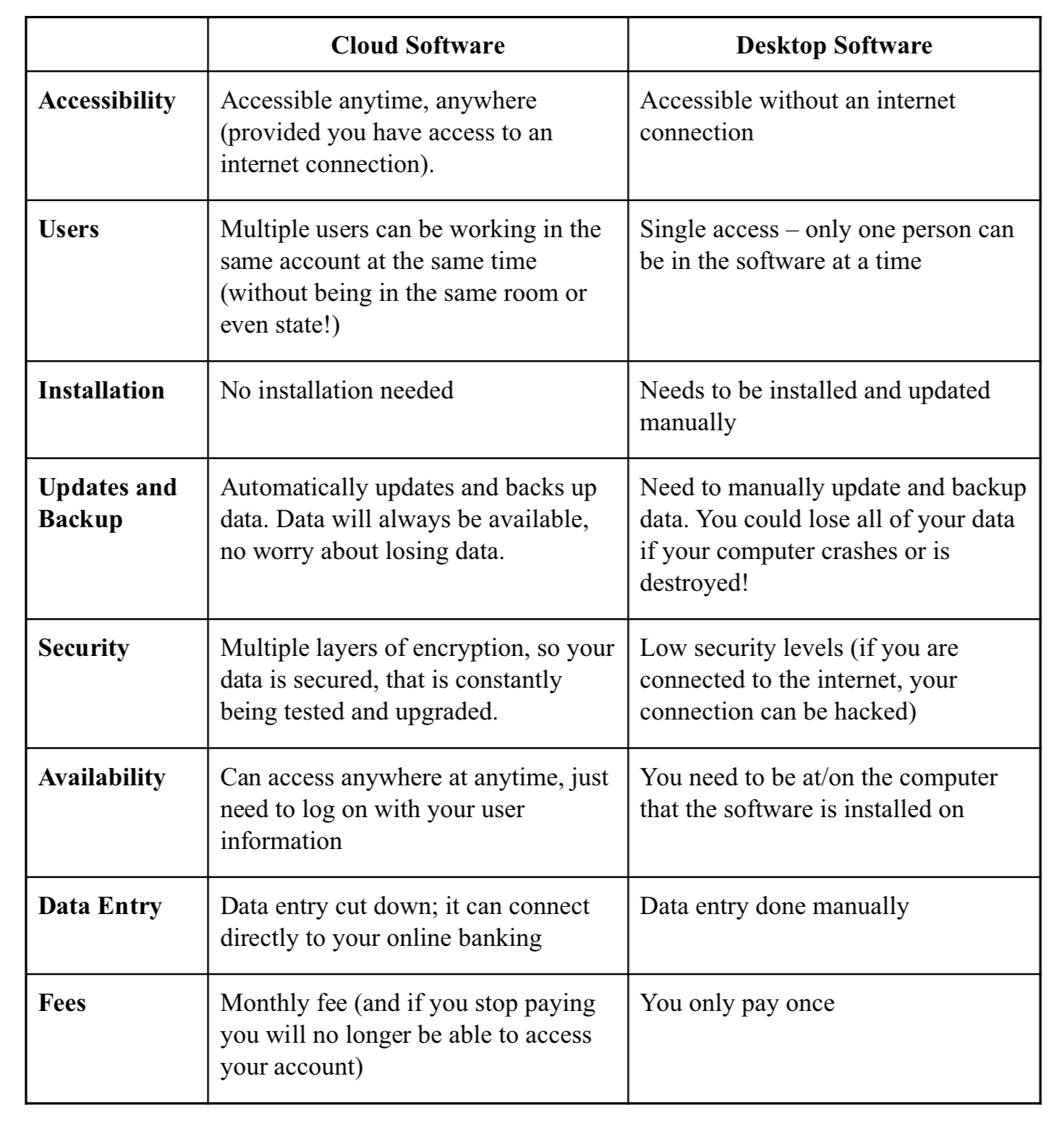

Why Should You Use Non-Cloud-Based Accounting Software?

- Data Security: With non-cloud software, your financial data is stored locally, reducing the risk of data breaches that can occur with cloud services.

- Control: You have complete control over your software and data, allowing for customized configurations and settings that suit your business needs.

- Cost-Effective: Many non-cloud solutions offer one-time purchase options, eliminating ongoing subscription fees associated with cloud services.

- Offline Access: You can access your accounting software without an internet connection, making it ideal for businesses in remote areas.

- Performance: Local software can often run faster than cloud-based solutions, especially when dealing with large datasets.

Source: www.lutzbookkeepingsolutions.com

Top Non-Cloud-Based Accounting Software Options for 2025

Now that we’ve established the benefits, let’s dive into the best non-cloud-based accounting software options available in 2025. Each of these products has unique features, pros, and cons, making them suitable for different types of users.

1. QuickBooks Desktop

QuickBooks Desktop is a well-known name in the accounting software industry. It offers a comprehensive suite of features tailored for small to medium-sized businesses.

Key Features:

- Invoicing and billing

- Expense tracking

- Payroll management

- Financial reporting

- Inventory management

Pros:

- User-friendly interface

- Extensive reporting capabilities

- Strong customer support

- Regular updates and improvements

- Integration with various third-party applications

Cons:

- Higher upfront cost

- Limited mobile access

- Can be overwhelming for beginners

- Requires regular updates

- Some features may be unnecessary for smaller businesses

2. Sage 50cloud (Desktop Version)

Sage 50cloud combines the power of desktop software with cloud capabilities, but it can also be used entirely offline. It’s designed for small to medium-sized businesses looking for robust accounting solutions.

Key Features:

- Advanced inventory management

- Job costing

- Customizable reporting

- Multi-currency support

- Payroll processing

Pros:

- Strong inventory management features

- Excellent customer support

- Customizable dashboards

- Comprehensive financial reporting

- User-friendly interface

Cons:

- Higher learning curve

- Can be expensive for small businesses

- Limited integrations with other software

- Requires regular updates

- Some users report performance issues

3. FreshBooks (Desktop Version)

FreshBooks is primarily known for its cloud-based solution, but it also offers a desktop version that can be used offline. It’s particularly popular among freelancers and small business owners.

Key Features:

- Time tracking

- Invoicing and billing

- Expense tracking

- Project management

- Client management

Pros:

- Intuitive and easy to use

- Excellent customer support

- Strong invoicing features

- Mobile app available

- Good for service-based businesses

Cons:

- Limited accounting features compared to competitors

- Can become expensive with add-ons

- Not suitable for larger businesses

- Limited reporting capabilities

- Requires internet for some features

4. Wave Accounting

Wave Accounting is a free accounting software option that offers a desktop version. It’s ideal for freelancers and small businesses looking for basic accounting features without the cost.

Key Features:

- Invoicing

- Expense tracking

- Receipt scanning

- Financial reporting

- Payroll (paid feature)

Pros:

- Free to use

- User-friendly interface

- Good for basic accounting needs

- Strong invoicing features

- No hidden fees

Cons:

- Limited features compared to paid software

- Customer support can be slow

- Not suitable for larger businesses

- Limited reporting capabilities

- Some features require internet access

5. Zoho Books (Desktop Version)

Zoho Books is part of the Zoho suite of applications and offers a desktop version that can be used offline. It’s designed for small to medium-sized businesses looking for a comprehensive accounting solution.

Key Features:

- Invoicing and billing

- Expense tracking

- Project management

- Financial reporting

- Multi-currency support

Pros:

- Affordable pricing

- User-friendly interface

- Strong reporting capabilities

- Good customer support

- Integration with other Zoho applications

Cons:

- Limited features in the free version

- Can be overwhelming for beginners

- Requires regular updates

- Some features may be unnecessary for smaller businesses

- Limited integrations with third-party applications

6. MYOB AccountRight

MYOB AccountRight is a popular accounting software option in Australia and New Zealand. It offers a desktop version that can be used offline, making it suitable for small to medium-sized businesses.

Key Features:

- Invoicing and billing

- Expense tracking

- Payroll management

- Inventory management

- Financial reporting

Pros:

- Strong payroll features

- User-friendly interface

- Good customer support

- Comprehensive reporting capabilities

- Regular updates and improvements

Cons:

- Higher upfront cost

- Limited mobile access

- Can be overwhelming for beginners

- Requires regular updates

- Some features may be unnecessary for smaller businesses

7. Xero (Desktop Version)

Xero is primarily known for its cloud-based solution, but it also offers a desktop version that can be used offline. It’s designed for small to medium-sized businesses looking for a comprehensive accounting solution.

Key Features:

- Invoicing and billing

- Expense tracking

- Payroll management

- Financial reporting

- Multi-currency support

Pros:

- User-friendly interface

- Strong reporting capabilities

- Good customer support

- Integration with various third-party applications

- Regular updates and improvements

Cons:

- Higher learning curve

- Can be expensive for small businesses

- Limited integrations with other software

- Requires regular updates

- Some users report performance issues

8. AccountEdge Pro

AccountEdge Pro is a desktop accounting software designed for small businesses. It offers a range of features to help manage finances effectively.

Key Features:

- Invoicing and billing

- Expense tracking

- Payroll management

- Inventory management

- Financial reporting

Pros:

- User-friendly interface

- Strong reporting capabilities

- Good customer support

- Comprehensive features for small businesses

- Regular updates and improvements

Cons:

- Higher upfront cost

- Limited mobile access

- Can be overwhelming for beginners

- Requires regular updates

- Some features may be unnecessary for smaller businesses

9. GnuCash

GnuCash is a free, open-source accounting software that can be installed on your desktop. It’s suitable for individuals and small businesses looking for basic accounting features.

Key Features:

- Double-entry accounting

- Invoicing and billing

- Expense tracking

- Financial reporting

- Multi-currency support

Pros:

- Free to use

- Open-source software

- Good for basic accounting needs

- Strong reporting capabilities

- No hidden fees

Cons:

- Limited features compared to paid software

- The user interface can be outdated

- Customer support can be slow

- Not suitable for larger businesses

- Some features require technical knowledge

10. Kashoo

Kashoo is a simple accounting software designed for small businesses and freelancers. It offers a desktop version that can be used offline.

Key Features:

- Invoicing and billing

- Expense tracking

- Financial reporting

- Multi-currency support

- Project management

Pros:

- User-friendly interface

- Good customer support

- Strong invoicing features

- Affordable pricing

- Regular updates and improvements

Cons:

- Limited features compared to competitors

- Can become expensive with add-ons

- Not suitable for larger businesses

- Limited reporting capabilities

- Some features require internet access

Source: obgoutsourcing.com

Pricing and Affordability

When considering non-cloud-based accounting software, pricing is a crucial factor. Here’s a breakdown of the pricing for the top options mentioned above:

| Software | Pricing Model | Estimated Cost (USD) |

|---|---|---|

| QuickBooks Desktop | One-time purchase | $299 – $499 |

| Sage 50cloud | Subscription | $300 – $600/year |

| FreshBooks | Subscription | $15 – $50/month |

| Wave Accounting | Free (with paid features) | Free |

| Zoho Books | Subscription | $9 – $29/month |

| MYOB AccountRight | Subscription | $300 – $600/year |

| Xero | Subscription | $11 – $62/month |

| AccountEdge Pro | One-time purchase | $399 – $499 |

| GnuCash | Free | Free |

| Kashoo | Subscription | $16.65/month |

Recommendations for Ideal Users

- Small Business Owners: QuickBooks Desktop and Sage 50cloud are excellent choices for small business owners who need comprehensive features and strong customer support.

- Freelancers: FreshBooks and Wave Accounting are ideal for freelancers looking for user-friendly invoicing and expense tracking.

- Budget-Conscious Users: GnuCash and Wave Accounting offer free options for those on a tight budget.

- Users Needing Strong Payroll Features: MYOB AccountRight and AccountEdge Pro are great for businesses that require robust payroll management.

- Users Seeking Simplicity: Kashoo and FreshBooks are perfect for users who want straightforward accounting without unnecessary complexity.

Source: www.capitalbusiness.net

Frequently Asked Questions about Non-Cloud Based Accounting Software

What are the benefits of non-cloud-based accounting software?

Non-cloud-based accounting software offers enhanced data security, complete control over your financial information, offline access, and often lower long-term costs compared to subscription-based cloud solutions.

How does non-cloud-based accounting software ensure data security?

By storing data locally on your hardware, non-cloud-based software minimizes the risk of data breaches associated with internet-based services. You can implement your security measures, such as firewalls and antivirus software.

Can I access non-cloud-based accounting software remotely?

Typically, non-cloud-based software is installed on a specific device, which means remote access may be limited. However, some solutions offer remote access features through VPNs or remote desktop applications.

Is non-cloud-based accounting software suitable for large businesses?

While many non-non-cloud-basedutions cater to small and medium-sized businesses, some can be scaled for larger organizations. It’s essential to evaluate the specific features and capabilities of each software to determine suitability.

How do I choose the right non-cloud-based accounting software for my business?

Consider your business size, budget, specific accounting needs, and desired features. It’s also helpful to read user reviews and take advantage of free trials when available.

Source: www.primeglobal.net

Conclusion

Exploring non-cloud-based accounting software opens up a world of possibilities for businesses seeking control, security, and efficiency in managing their finances. With a variety of options available in 2025, you can find the perfect solution tailored to your unique needs. Whether you prioritize data security, offline access, or cost-effectiveness, there’s a non-cloud option that fits the bill.

Take the time to evaluate your business requirements, explore the software options listed above, and make an informed decision that will empower your financial management. Don’t hesitate to reach out for more information, explore additional resources, or share your experiences in the comments below!