In the world of charitable giving, tracking kind donations can be a challenge. Whether you’re a nonprofit organization or an individual looking to manage your charitable contributions, having the right accounting software can make all the difference. In this blog post, we’ll explore the best accounting software for kind donations, why you should use them, and how they can simplify your donation tracking process.

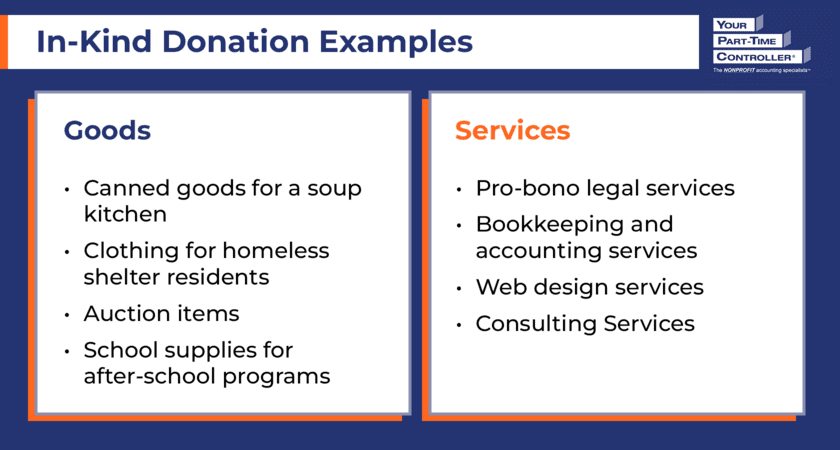

Source: www.yptc.com

What is Accounting Software for Kind Donations?

Accounting software for kind donations is a specialized tool designed to help organizations and individuals track, manage, and report on non-cash contributions. These contributions can include items like clothing, food, or services, which can be challenging to value and record accurately.

Why Should You Use Accounting Software for Kind Donations?

Using accounting software for kind donations offers several benefits:

- Accurate Tracking: Easily record and value donations.

- Tax Compliance: Ensure you meet IRS requirements for reporting non-cash donations.

- Time-Saving: Automate processes to save time and reduce errors.

- Enhanced Reporting: Generate detailed reports for stakeholders and tax purposes.

- Improved Transparency: Maintain clear records that can be shared with donors and regulatory bodies.

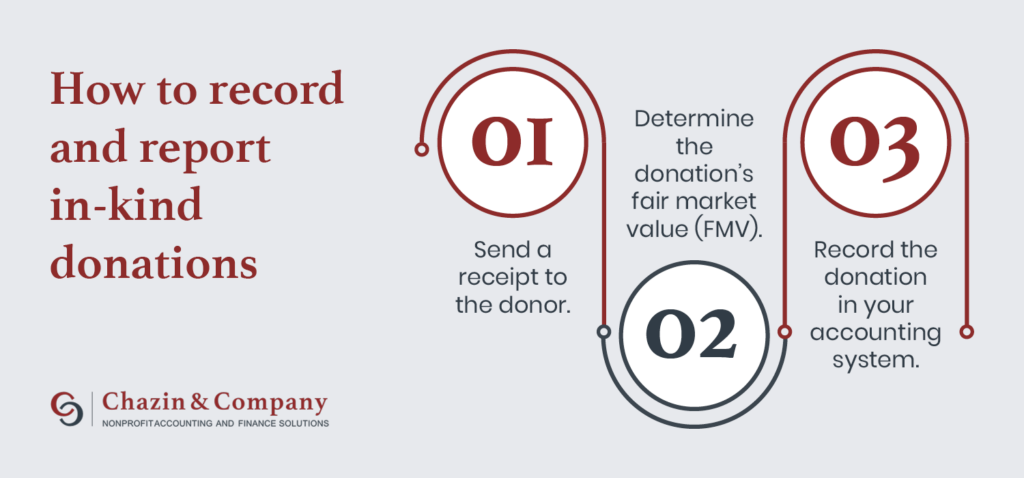

Source: www.chazinandcompany.com

Top Accounting Software for Kind Donations in 2025

Let’s dive into the best accounting software options available for managing kind donations in 2025.

1. QuickBooks Online

QuickBooks Online is a popular choice for many nonprofits and individuals alike. It offers a user-friendly interface and robust features tailored for donation tracking.

Source: www.cfoselections.com

Key Features:

- Customizable donation tracking

- Automated reporting

- Integration with payment processors

Pros:

- Easy to use

- Excellent customer support

- Mobile app available

- Integrates with other software

- Scalable for growing organizations

Cons:

- Monthly subscription fees can add up

- Limited features in the lower-tier plans

- Learning curve for advanced features

- Not specifically designed for nonprofits

- May require additional training

2. DonorPerfect

DonorPerfect is specifically designed for nonprofits, making it an excellent choice for tracking kind donations.

Key Features:

- Comprehensive donor management

- Customizable donation forms

- Automated thank-you letters

Pros:

- Tailored for nonprofits

- Strong reporting capabilities

- User-friendly interface

- Excellent custoaccountingt

- Integration with various payment processors

Cons:

- Higher cost compared to general accounting software

accountingmobile functionality

- Some features may be overwhelming for small organizations

- Requires internet access

- Initial setup can be time-consuming

3. Aplos

Aplos is another nonprofit-focused accounting software that simplifies donation tracking and reporting.

Key Features:

- Fund accounting

- Donation tracking

- Customizable reports

Pros:

- Specifically designed for nonprofits

- Affordable pricing

- Easy to navigate

- Strong customer support

- Good for small to mid-sized organizations

Cons:

- Limited features compared to larger software

- May lack advanced reporting options

- Not suitable for larger organizations

- Some users report bugs

- Limited integrations with other software

4. Xero

Xero is a cloud-based accounting software that is gaining popularity among nonprofits for its flexibility and ease of use.

Key Features:

- Real-time financial reporting

- Bank reconciliation

- Multi-currency support

Pros:

- User-friendly interface

- Strong mobile app

- Excellent integration options

- Good for international donations

- Affordable pricing plans

Cons:

- Limited nonprofit-specific features

- Customer support can be slow

- Learning curve for advanced features

- Not as robust as some competitors

- May require additional training

5. FreshBooks

FreshBooks is known for its invoicing capabilities but also offers features for tracking donations.

Key Features:

- Time tracking

- Expense tracking

- Customizable invoices

Pros:

- Easy to use

- Excellent customer support

- Good for freelancers and small nonprofits

- Strong mobile app

- Affordable pricing

Cons:

- Limited reporting features

- Not specifically designed for nonprofits

- May lack advanced accounting features

- Limited integrations

- Can become expensive as you add users

6. Sage Intacct

Sage Intacct is a powerful accounting software that offers advanced features for larger nonprofits.

Key Features:

- Advanced financial management

- Multi-entity support

- Customizable dashboards

Pros:

- Highly customizable

- Strong reporting capabilities

- Excellent for larger organizations

- Good customer support

- Scalable as your organization grows

Cons:

- Higher cost

- Steeper learning curve

- Not suitable for small organizations

- Requires dedicated IT resources

- Initial setup can be complex

7. Blackbaud Financial Edge NXT

Blackbaud Financial Edge NXT is a comprehensive solution for nonprofits looking to manage their finances effectively.

Key Features:

- Fund accounting

- Grant management

- Advanced reporting

Pros:

- Tailored for nonprofits

- Strong reporting capabilities

- Excellent customer support

- Good for larger organizations

- Integration with other Blackbaud products

Cons:

- Higher cost

- Steep learning curve

- Requires dedicated IT resources

- Limited mobile functionality

- Initial setup can be time-consuming

8. Wave

Wave is a free accounting software option that can be useful for small nonprofits and individuals.

Key Features:

- Free accounting software

- Invoice creation

- Expense tracking

Pros:

- Completely free

- User-friendly interface

- Good for small organizations

- Basic reporting features

- No monthly fees

Cons:

- Limited features compared to paid software

- Not specifically designed for nonprofits

- Customer support can be slow

- Limited integrations

- May lack advanced reporting options

9. CharityEngine

CharityEngine is a comprehensive donor management system that also includes accounting features.

Key Features:

- Donor management

- Event management

- Automated reporting

Pros:

- Tailored for nonprofits

- Strong donor management features

- Good customer support

- Excellent for fundraising events

- Integration with various payment processors

Cons:

- Higher cost

- Steep learning curve

- Limited mobile functionality

- Some features may be overwhelming for small organizations

- Initial setup can be time-consuming

10. Nonprofit Treasurer

Nonprofit Treasurer is a simple, affordable solution for small nonprofits looking to manage their finances.

Key Features:

- Fund accounting

- Donation tracking

- Basic reporting

Pros:

- Affordable pricing

- Easy to use

- Good for small organizations

- Basic features for managing donations

- No monthly fees

Cons:

- Limited features compared to larger software

- Not suitable for larger organizations

- Some users report bugs

- Limited integrations

- Basic reporting capabilities

Source: www.yptc.com

Pricing and Affordability

Here’s a quick comparison of the pricing for the accounting software options mentioned:

| Software | Pricing (Monthly) |

|---|---|

| QuickBooks Online | $25 – $150 |

| DonorPerfect | $99 – $299 |

| Aplos | $49 – $149 |

| Xero | $12 – $65 |

| FreshBooks | $15 – $50 |

| Sage Intacct | $400+ |

| Blackbaud Financial Edge NXT | $300+ |

| Wave | Free |

| CharityEngine | $100 – $500 |

| Nonprofit Treasurer | $10 – $30 |

Recommendations for Ideal Users

- Small Nonprofits: Consider using Wave or Nonprofit Treasurer for their affordability and ease of use.

- Medium-Sized Nonprofits: Aplos or FreshBooks can provide the right balance of features and pricing.

- Large Nonprofits: Blackbaud Financial Edge NXT or Sage Intacct are ideal for their advanced features and scalability.

Frequently Asked Questions

What are the benefits of using accounting software for kind donations?

Using accounting software helps ensure accurate tracking, compliance with tax regulations, and saves time through automation.

How do I choose the right accounting software for my nonprofit?

Consider your organization’s size, budget, and specific needs. Look for software that offers features tailored to nonprofits.

Can I track non-cash donations with accounting software?

Yes, most accounting software designed for nonprofits includes features for tracking non-cash donations.

Is accounting software necessary for small nonprofits?

While not mandatory, accounting software can greatly simplify financial management and ensure compliance with regulations.

How can accounting software help with tax reporting?

Accounting software can generate reports that detail your donations, making it easier to file taxes accurately.

Conclusion

Managing kind donations doesn’t have to be a daunting task. With the right accounting software, you can streamline your processes, ensure compliance, and focus on what truly matters—making a difference in your community.

Take the time to explore the options available and choose the one that best fits your needs. Whether you’re a small nonprofit or a larger organization, there’s a solution out there for you.

Ready to take the next step? Explore additional resources, subscribe for more insights, or leave a comment below to share your experiences with accounting software for kind donations!

Watch This Video on accounting software in kind donations