3. Stessa – Best Free Option for Budget-Conscious Flippers

Let’s be honest — not everyone wants to spend money on software right away, especially if you’re new to flipping. If that’s you, Stessa is a strong contender.

Key Highlights:

- 100% free (yes, really)

- Designed for real estate investors

- Tracks income, expenses, property value, and cash flow

- Offers Schedule E reports for taxes

- Includes a mobile app and receipt scanning

What You Miss:

- No full bookkeeping like double-entry accounting

- Lacks payroll and invoicing features

But if you’re just starting, Stessa gives you a solid foundation.

4. Buildium – Best for Flippers Managing Rentals Too

If you flip homes and manage a few rental properties on the side, Buildium is worth a look. It’s designed for property management but works well for hybrid real estate entrepreneurs.

Why It’s Ideal for Dual Roles:

- Allows you to manage income/expenses across multiple units or properties

- Built-in tenant and lease tracking (handy if you rent before you sell)

- Generates owner and tax reports

- Bank reconciliations and ePay options

When to Use It:

Let’s say you renovate homes, rent them for a year to get cash flow, then sell. Buildium helps track everything — from rent collection to maintenance costs — until the property is sold.

Drawbacks:

It may feel overwhelming if you’re only flipping and not renting. Pricing starts at $55/month, higher than others on this list.

If you’re juggling flips and rentals, Buildium offers all-in-one convenience.

Source: www.reikit.com

5. Wave Accounting – Best Free Tool for DIY Bookkeeping

Need something simple and free, but don’t want to sacrifice double-entry accounting? The wave is perfect.

Why I Like It:

- 100% free for accounting and invoicing

- Bank and credit card syncing

- Simple dashboard with reports like profit/loss and balance sheet

- Easy to categorize property expenses

A Client Story:

One of my clients in North Carolina flipped two homes a year and didn’t want a monthly bill for software. She used Wave to track all transactions, upload receipts, and export everything to her accountant. Worked like a charm.

Limitations:

No project-specific tagging (you’ll need to manually name expenses). No built-in property features or tax help.

Still, it’s a great entry-level solution for flippers on a budget.

Source: www.instagram.com

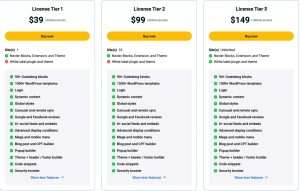

Side-by-Side Comparison Table

Here’s a quick look at how these tools stack up:

| Software | Price | Best For | Property Tracking | Mobile App | Tax Prep |

|---|---|---|---|---|---|

| QuickBooks | $30–$90/month | Most flippers | ✅ (via projects) | ✅ | ✅ |

| REI Hub | $15+/month | Real estate-specific features | ✅ | ✅ | ✅ |

| Stessa | Free | Budget-conscious flippers | ✅ | ✅ | ✅ |

| Buildium | $55+/month | Flippers + rental managers | ✅ | ✅ | ✅ |

| Wave | Free | New flippers or small-scale DIY | ❌ (manual tags) | ✅ | ❌ |

Source: m.youtube.com

How to Choose the Right Accounting Tool Based on Your Flipping Style

Not all flippers operate the same way. Your software choice depends on how you run your business.

👉 If You Flip Full-Time…

Go for QuickBooks Online or REI Hub. These tools are robust enough to handle large volumes of transactions and offer features that scale with your business.

👉 If You Flip Part-Time or as a Side Hustle…

Stessa or Wave are great free tools that keep your costs low while still giving you clarity on your finances.

👉 If You Also Manage Rentals…

Buildium is tailored to those who rent and flip. It’s worth the investment if rentals are part of your income strategy.

👉 If You Work With an Accountant…

Choose a tool that allows an accountant access, like QuickBooks or Wave. This streamlines communication during tax season.

Source: www.flipperforce.com

Tips to Get the Most Out of Your Software

I’ve helped clients implement these tools over the years, and here’s what I always suggest:

1. Tag Every Transaction

Whether you’re flipping one home or ten, tag every expense and income item to a specific property. This ensures accurate profit/loss reports.

2. Automate Where You Can

Use bank feeds, receipt scanners, and invoice generators to save time. Apps like QuickBooks and Stessa make this easy.

3. Reconcile Monthly

Block 30 minutes a month to review and reconcile your books. It saves hours of headaches later.

4. Export Reports Before Tax Season

Generate key reports like:

- Profit and loss per property

- Expense summary

- Capital improvements

- Contractor payments (for 1099s)

Give these to your accountant to streamline your return.

5. Back Up Your Data

Even if your software is cloud-based, make monthly exports to PDF or CSV. This is your safety net if anything goes wrong.

Source: forefrontcrm.com

Real Talk: Do You Need Paid Accounting Software?

Look, I get it. Spending $30–$90/month on software might feel like a waste, especially when you’re just starting. But here’s something I learned the hard way (and have seen others struggle with):

“Bad accounting doesn’t just cost you money — it costs you your business.”

I’ve seen people lose out on deductions, underpay taxes (then face penalties), or miscalculate their margins and overpay for a flip. Software isn’t just about staying organized. It’s about protecting your profits, staying compliant, and planning your next move with confidence.

Real-Life Lessons: What I’ve Learned Helping Flippers Organize Their Finances

In my time consulting with small real estate investors and digital-first entrepreneurs, I’ve witnessed both wild success and frustrating flops—all because of how the money was (or wasn’t) managed.

💡 Case Study: The Disappearing $15,000 Profit

One of my clients in Florida flipped a modest 3-bedroom home and expected a $15,000 profit. But by the time they paid contractors, covered holding costs, and accounted for surprise repairs, they barely broke even.

The problem?

They tracked expenses in a spreadsheet but forgot to:

- Include utilities and insurance in monthly costs

- Separate capital improvements from routine repairs

- Account for 1099 contractor payments (leading to tax headaches)

After switching to REI Hub, they started logging every dollar in real-time. Their next project showed a clear 18% ROI. The difference wasn’t in how they flipped—it was in how they tracked it.

What Makes Accounting Challenging for Flippers?

Accounting for real estate flipping isn’t the same as running a regular business. You’re dealing with:

- Short-term inventory (properties)

- Large one-time expenses (like remodels)

- Capital gains taxes

- Project-based budgeting

And because each flip is like its own mini-business, it’s easy to lose sight of cash flow when you’re managing multiple properties.

Common Mistakes I See:

- Mixing Personal and Business Finances: Keep a separate bank account. Seriously—it’ll save you a ton of time.

- Forgetting About Carrying Costs: Mortgage payments, utilities, taxes, insurance—all count even if you’re not living there.

- Not Tracking Mileage or Small Receipts: A $4 coffee run or 10 miles to a hardware store might seem minor, but they add up—and are deductible.

- Overpaying Subcontractors Without Contracts: Always document what you pay contractors. And make sure you collect W-9s for 1099 filing.

- Not Forecasting Sales Price Properly: Use comps, yes—but factor in seasonality and local market changes before you commit to a flip.

A Personal Lesson:

Years ago, I helped a flipper in Austin who used a basic spreadsheet to track everything. On paper, it looked fine. But when we broke things down in QuickBooks, we found she was underreporting $9,000 in materials she bought in cash. That underreporting didn’t just hurt her taxes—it skewed her entire ROI picture.

Once we linked her bank feed and added photo receipts via the mobile app, she never missed a transaction again. It was a game-changer.

Expert Strategies to Streamline Flipping Finances

1. Use Project-Based Accounting

Every flip should be treated like a separate project:

- Create a new “class” or “tag” in your software for each property.

- This lets you see profit and loss per deal, not just overall.

2. Set a “Max Spend” Rule

Before demo day, set a ceiling budget based on your ARV (After Repair Value). Then plug that into your software and monitor in real time.

Tip: Tools like Stessa or REI Hub can send you alerts if you exceed your renovation budget.

3. Use a Receipt App

Instead of tossing Home Depot receipts in a glove box, use mobile apps to:

- Snap a photo

- Assign it to a property

- Instantly categorize it

QuickBooks, Stessa, and Wave all have this feature.

4. Export Reports for Private Lenders

If you borrow from private investors, they’ll want updates. Having clean financial reports builds trust and helps secure future funding. I had one client in New Jersey who closed three more deals just because his investor loved how clean his reports looked from REI Hub.

5. Schedule Monthly “Money Meetings”

Set aside one hour each month to:

- Review your profit/loss

- Match receipts to expenses

- Plan cash flow for the next flip

If you have a partner or spouse in the business, do it together. You’ll catch errors early and stay on the same page.

What About Taxes?

Taxes can get complicated for real estate flippers. Your profits are usually taxed as ordinary income, not capital gains—unless you hold properties longer than a year. That’s why tracking every deductible expense is critical.

Common Deductions:

- Closing costs

- Materials and labor

- Holding costs (interest, utilities, insurance)

- Business use of your car

- Software subscriptions

- Home office (if you manage your business from home)

Bonus: Most of the paid software mentioned here lets you tag these categories automatically. But here’s the key: You must keep proof. That means digital receipts, contractor invoices, and clear financial reports.

If you ever get audited or want to refinance based on your business income, having everything documented makes the process smoother.

How to Integrate Accounting Software Into Your Real Estate Flipping Workflow

When you’re flipping houses, your days are packed. You’re managing contractors, sourcing deals, pulling permits, talking to realtors—and often, you’re wearing all those hats yourself. The last thing you want is complicated software slowing you down. That’s why choosing accounting software that fits your workflow is more important than just picking the most feature-rich one.

🧩 Step 1: Match the Tool to Your Style

Are you tech-savvy? Do you hate data entry? Do you want something mobile-friendly?

For example:

- If you’re tech-savvy and want deep financials, → Go with QuickBooks Online or Xero.

- If you want simple, real estate-focused software, try REI Hub or Stessa.

- If you want completely free but functional software, → reconsider Wave.

- If you want CRM + accounting in one, → Check out Realeflow.

Don’t force yourself into something that feels unnatural. Accounting tools are only powerful if you use them.

📱 Step 2: Set Up Bank and Card Integrations

Most good accounting tools will let you:

- Link your bank accounts

- Link your credit cards

- Automatically import and categorize transactions.

This is a game-changer. You’ll never forget a purchase, and you won’t need to save paper receipts anymore.

Tip: Create rules inside your software.

Example: Every transaction from “Lowe’s” is automatically marked as “Property Repairs.”

🏗 Step 3: Use Tags, Projects, or Classes

Tag each transaction to a property address or flip ID. This lets you:

- Track profitability by property

- Identify which deals are most efficient

- Budget smarter for future projects

In QuickBooks Online, use Classes. In REI Hub, use Properties. In Stessa, just assign each transaction to the proper unit. You’ll be surprised how much clarity this one step brings.

🧾 Step 4: Use Mobile Apps for Field Work

You (or your team) can:

- Snap receipts as soon as they’re issued

- Enter expenses while leaving a job site

- Check budgets from your phone

Mobile apps eliminate the “I’ll enter that later” trap, where data entry gets delayed and forgotten. I had one client in Michigan whose handyman logged every receipt in Stessa. At the end of the month, his accountant had everything needed—no chasing down paperwork.

🔁 Step 5: Review Weekly or Bi-Weekly

Even with automation, you still need to look at your books regularly. Why? You’ll spot overages before they get out of hand. You can prepare taxes early. You’ll make smarter decisions on upcoming flips. It doesn’t have to take more than 30 minutes. Just log in, check your dashboard, verify income and expenses, and export a snapshot for your records.

Choosing Software Based on Your Business Size

Here’s a breakdown of the best accounting software for real estate flippers, depending on where you are in your journey.

👶 Just Getting Started (1 Flip/Year)

Tool: Wave or Stessa

Why: Free, simple, and perfect for low volume

Features to focus on: Expense tracking, receipt storage, profit/loss reports

Personal Tip: Stessa is a winner here—it’s real estate specific, very intuitive, and helps keep early flippers organized without overwhelm.

👨🔧 Solo Flipper With 2–4 Projects/Year

Tool: REI Hub or QuickBooks Online

Why: More power, still easy to manage

Features to focus on: Property-based tracking, vendor management, basic tax reporting

Personal Tip: REI Hub shines for mid-size flippers. It’s not bloated like some big-name tools, and its interface is tailored for real estate.

🧑💼 Small Team or Growing Business

Tool: QuickBooks Online Advanced or Xero

Why: Multi-user, more integrations, robust reporting

Features to focus on: Payroll, custom reports, integrations with CRMs, and deal pipelines

Real Example: I worked with a team in California that used QBO with custom classes for each property, a virtual bookkeeper, and a shared dashboard for their whole team. Their workflow ran like clockwork.

💼 Full-Time Flipping Business or Multi-State Operations

Tool: AppFolio, Buildium, or Realeflow

Why: These are high-end tools with everything from property management to lead generation

Features to focus on: CRM, automation, deep analytics, and advanced forecasting

Important: These tools often require more setup, training, and investment. Only choose them if you have the team and deal volume to justify it.

Integrating with Other Tools You Use

If you’re already using tools like:

- Google Sheets (budgeting)

- Dropbox (document storage)

- DocuSign (contracts)

- Slack or Trello (team communication)

Look for accounting software that plays nice with them. QuickBooks, Xero, and even Wave support many third-party integrations.

Example: You can use Zapier to auto-send new transaction alerts to Slack. Or back up receipts from QuickBooks to Dropbox weekly.

Holding Costs

You can do this by:

- Creating categories or tags for each type of expense

- Assigning each expense to the specific property

- Running a “project” or “class” report for that flip

This kind of breakdown helps you avoid budgeting errors. I’ve seen people overspend because they lumped all costs together and didn’t realize how much was going toward repairs.

Frequently Asked Questions (FAQs)

1. What’s the best free accounting software for real estate flippers?

If you’re just getting started, I highly recommend Stessa. It’s 100% free and built specifically for real estate investors. It allows you to:

- Track income and expenses by property

- Scan and store receipts.

- View real-time dashboards showing ROI and cash flow.

Wave is another free option, but it’s more general-purpose and lacks real estate-specific features like property tagging. I’ve seen new investors get overwhelmed using QuickBooks too early. Stessa keeps things simple and focused on what matters.

2. Do I need accounting software if I only flip one or two houses per year?

Honestly? Yes. Even if you’re doing just one deal a year, you still need to:

- Track expenses and revenue

- Categorize contractor payments

- File taxes accurately

- Understand if you’re truly making a profit.

I’ve worked with clients who thought they made $20,000 on a flip—until software revealed that after permits, holding costs, and fees, their profit was just $8,000. Even light use of software like Wave or Stessa will give you clarity and help avoid costly mistakes.

3. Can I use QuickBooks for flipping houses, or is it only for traditional businesses?

QuickBooks is one of the best tools for flippers, especially once you get beyond two or three deals a year. With QuickBooks Online, you can:

- Tag expenses to each flip using “Classes.”

- Run profit/loss reports per property.

- Automate bank feeds and categorize transactions.

- Invite your bookkeeper or CPA securely.

However, there’s a learning curve. I recommend setting it up with help from a real estate-savvy bookkeeper. Once it’s dialed in, though, it’s a beast.

4. How do I choose the right software if I plan to grow fast?

If you’re planning to scale, choose a tool that:

- Supports multiple users

- Offers mobile access

- Integrates with tools like CRMs, contractor management, and marketing platforms

- Can handle multiple properties with strong reporting features

QuickBooks Online Advanced, Xero, and Realeflow are great for fast-growing flippers. Think long-term. I once consulted for a flipper who grew from 3 flips/year to 15 in two years—and because he chose QBO early on, he didn’t have to overhaul his system later.

5. What’s the easiest accounting software to use with minimal setup?

If you’re not techy or just want something you can set up in 30 minutes, go with:

- Stessa (best for real estate-specific use)

- Wave (best for general tracking)

Both are easy to use, offer clean dashboards, and get you rolling fast without needing a full accounting background. And honestly, ease of use is often more important than features—if the software feels too complicated, you won’t use it.

6. Can I track rehab costs separately from the purchase price?

Absolutely—and you should. Most good accounting platforms let you break down:

- Purchase cost

- Rehab/repair expenses

- Holding costs

- Selling costs

You can do this by:

- Creating categories or tags for each type of expense

- Assigning each expense to the specific property

- Running a “project” or “class” report for that flip

This kind of breakdown helps you avoid budgeting errors. I’ve seen people overspend because they lumped all costs together and didn’t realize how much was going toward repairs.

7. Is hiring a bookkeeper necessary if I use software?

Not always, but it can help. If you’re doing fewer than 3 flips a year and have simple finances, you can probably DIY your books using software like Stessa or Wave.

But once you:

- Start hiring contractors

- Use a business credit card

- Flip more than 3 homes per year

- Have multiple holding companies or LLCs

…it’s worth bringing on a bookkeeper, at least part-time. Software + human expertise is the dream team. I’ve personally seen a flipper go from chaotic spreadsheets to a clear, CPA-ready dashboard by working with a bookkeeper who specialized in QBO and real estate.

Conclusion: Choosing the Right Accounting Software for Real Estate Flipping Success

After working with dozens of real estate investors over the years—from weekend warriors flipping one property a year to full-time pros juggling multiple projects—I’ve seen how the right accounting software can make or break a business.

Whether you’re a first-time flipper or scaling into a 7-figure operation, having a system that tracks your numbers with precision is non-negotiable. It’s the foundation of good decision-making, clean tax filings, and ultimately, your bottom line.