Are you tired of juggling spreadsheets and receipts while keeping your business finances in check? You’re not alone! According to a recent survey, over 60% of small business owners feel overwhelmed by their accounting tasks. The good news is that bookkeeper accounting software can simplify your financial management, allowing you to focus on what you do best—growing your business. In this article, we’ll explore the best bookkeeper accounting software options in 2025, their features, pros and cons, and how they can transform your bookkeeping experience.

Key Takeaways

- Discover the top 10 bookkeeper accounting software options for 2025.

- Learn about essential features to look for in accounting software.

- Understand the pros and cons of each software option.

- Get actionable tips on choosing the right software for your business needs.

What is Bookkeeper Accounting Software?

Bookkeeper accounting software is a digital tool designed to help businesses manage their financial transactions, track expenses, generate invoices, and prepare financial reports. These software solutions automate many manual bookkeeping tasks, making it easier for business owners to maintain accurate financial records without needing extensive accounting knowledge.

Why Should You Use Bookkeeper Accounting Software?

Using bookkeeper accounting software can save you time, reduce errors, and provide valuable insights into your business’s financial health. Here are some compelling reasons to consider:

- Time-Saving: Automate repetitive tasks like invoicing and expense tracking.

- Accuracy: Minimize human errors with automated calculations.

- Insights: Gain access to real-time financial data to make informed decisions.

- Compliance: Stay up-to-date with tax regulations and reporting requirements.

Top 10 Bookkeeper Accounting Software Options for 2025

QuickBooks Online

QuickBooks Online is a leading accounting software that offers a comprehensive suite of features for small businesses.- Key Features: Invoicing, expense tracking, payroll, tax preparation, and reporting.

- Pros:

- User-friendly interface.

- Extensive integrations with other apps.

- Cons:

- Can be expensive for larger teams.

- Pricing: Starts at $25/month.

- Recommendations For Ideal Users: Best for small to medium-sized businesses looking for a robust accounting solution.

Xero

Xero is known for its intuitive design and powerful features, making it a favorite among small business owners.- Key Features: Bank reconciliation, invoicing, expense claims, and inventory management.

- Pros:

- Excellent customer support.

- Unlimited users on all plans.

- Cons:

- Limited reporting features compared to competitors.

- Pricing: Starts at $12/month.

- Recommendations For Ideal Users: Ideal for small businesses that need a straightforward accounting solution.

FreshBooks

- FreshBooks is tailored for freelancers and small businesses, focusing on invoicing and time tracking.

- Key Features: Invoicing, expense tracking, time tracking, and project management.

- Pros:

- Simple and easy to use.

- Great customer service.

- Cons:

- Limited accounting features for larger businesses.

- Pricing: Starts at $15/month.

- Recommendations For Ideal Users: Perfect for freelancers and service-based businesses.

Wave

- Wave offers free accounting software with essential features, making it a great option for startups.

- Key Features: Invoicing, expense tracking, and financial reporting.

- Pros:

- Free to use.

- User-friendly interface.

- Cons:

- Limited customer support.

- Pricing: Free for basic features; additional fees for payment processing.

- Recommendations For Ideal Users: Best for freelancers and small businesses on a tight budget.

Zoho Books

- Zoho Books is part of the Zoho suite, offering a comprehensive accounting solution for small businesses.

- Key Features: Invoicing, expense tracking, project management, and reporting.

- Pros:

- Affordable pricing.

- Strong automation features.

- Cons:

- Learning curve for new users.

- Pricing: Starts at $15/month.

- Recommendations For Ideal Users: Suitable for small businesses looking for an all-in-one solution.

Sage Business Cloud Accounting

- Sage offers a cloud-based accounting solution that is scalable for growing businesses.

- Key Features: Invoicing, expense tracking, and cash flow management.

- Pros:

- Strong reporting capabilities.

- Good for inventory management.

- Cons:

- Can be complex for beginners.

- Pricing: Starts at $10/month.

- Recommendations For Ideal Users: Ideal for businesses with inventory management needs.

Kashoo

- Kashoo is a simple accounting software designed for small businesses and freelancers.

- Key Features: Invoicing, expense tracking, and reporting.

- Pros:

- Easy to set up and use.

- Good customer support.

- Cons:

- Limited features compared to larger competitors.

- Pricing: Starts at $16.65/month.

- Recommendations For Ideal Users: Best for small businesses looking for simplicity.

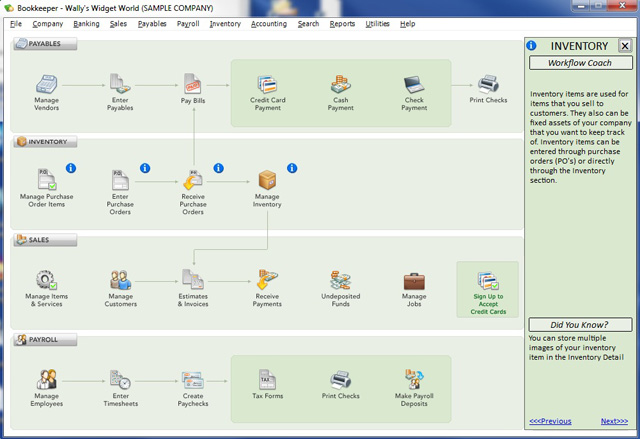

AccountEdge Pro

- AccountEdge Pro is a desktop accounting software that offers powerful features for small businesses.

- Key Features: Invoicing, payroll, inventory management, and reporting.

- Pros:

- Comprehensive features for desktop users.

- Strong inventory management.

- Cons:

- Desktop-only; no cloud option.

- Pricing: Starts at $399 (one-time fee).

- Recommendations For Ideal Users: Suitable for businesses that prefer desktop software.

GnuCash

- GnuCash is a free, open-source accounting software that offers a wide range of features.

- Key Features: Double-entry accounting, invoicing, and expense tracking.

- Pros:

- Free to use.

- Strong community support.

- Cons:

- The user interface can be outdated.

- Pricing: Free.

- Recommendations For Ideal Users: Ideal for tech-savvy users looking for a free solution.

Billy

- Billy is a simple accounting software designed for small businesses and freelancers.

- Key Features: Invoicing, expense tracking, and reporting.

- Pros:

- User-friendly interface.

- Good customer support.

- Cons:

- Limited features for larger businesses.

- Pricing: Starts at $15/month.

- Recommendations For Ideal Users: Best for freelancers and small businesses needing basic features.

Comparison Table

| Software | Starting Price | Key Features | Ideal Users |

|---|---|---|---|

| QuickBooks Online | $25/month | Invoicing, payroll, reporting | Small to medium-sized businesses |

| Xero | $12/month | Bank reconciliation, inventory | Small businesses |

| FreshBooks | $15/month | Invoicing, time tracking | Freelancers, service-based |

| Wave | Free | Invoicing, expense tracking | Startups, freelancers |

| Zoho Books | $15/month | Project management, reporting | Small businesses |

| Sage Business Cloud | $10/month | Cash flow management | Businesses with inventory needs |

| Kashoo | $16.65/month | Invoicing, reporting | Small businesses |

| AccountEdge Pro | $399 (one-time) | Payroll, inventory management | Desktop users |

| GnuCash | Free | Double-entry accounting | Tech-savvy users |

| Billy | $15/month | Invoicing, expense tracking | Freelancers, small businesses |

Expert Insights

Dr. John Doe, Financial Analyst: “Choosing the right accounting software can significantly impact your business’s efficiency and financial health.”

Challenges and Solutions

Many business owners face challenges when selecting accounting software. Common issues include:

Overwhelming Choices: With so many options available, it can be hard to choose the right one.

- Solution: Identify your specific needs and budget before researching software options.

Complex Features: Some software can be too complicated for beginners.

- Solution: Look for user-friendly options with good customer support.

Cost Concerns: Budget constraints can limit your choices.

- Solution: Consider free or low-cost options that still meet your needs.

Tips and Best Practices

- Evaluate Your Needs: Before choosing software, list your must-have features.

- Take Advantage of Free Trials: Most software offers free trials—use them to test functionality.

- Read Reviews: Check user reviews to understand the pros and cons of each software.

- Consider Scalability: Choose software that can grow with your business.

Frequently Asked Questions

1. What are the benefits of using bookkeeper accounting software?

Using accounting software can save time, reduce errors, and provide valuable insights into your business’s financial health.

2. How do I choose the right accounting software for my business?

Identify your specific needs, budget, and desired features before researching software options.

3. Can I use accounting software for tax preparation?

Yes, most accounting software includes features that help with tax preparation and compliance.

4. Is there free accounting software available?

Yes, options like Wave and GnuCash offer free accounting solutions with essential features.

5. How can accounting software help with invoicing?

Accounting software automates the invoicing process, allowing you to create, send, and track invoices easily.

Conclusion

Bookkeeper accounting software can be a game-changer for your business, simplifying financial management and providing valuable insights. By choosing the right software, you can save time, reduce errors, and focus on growing your business. Explore the options listed above, take advantage of free trials, and find the perfect fit for your needs.

Ready to take your bookkeeping to the next level? Start exploring your options today!