Are you curious about the tools that keep accountants organized and efficient? You’re not alone! A recent survey revealed that over 70% of accountants believe that using the right software significantly boosts their productivity. With the financial landscape constantly evolving, understanding what software accountants use is crucial for anyone looking to enter the field or improve their financial management skills. In this article, we’ll explore the essential software tools that accountants rely on, their key features, and how they can help streamline your accounting processes.

Key Takeaways

- Accountants use various software tools for tasks like bookkeeping, tax preparation, and financial analysis.

- Popular software options include QuickBooks, Xero, and FreshBooks.

- Each software has unique features, pros, and cons that cater to different accounting needs.

- Understanding these tools can enhance your financial management skills.

What Software Do Accountants Use?

Accountants utilize a range of software solutions to manage financial data, prepare taxes, and ensure compliance with regulations. Here’s a closer look at some of the most popular software options available in 2025.

Why Should People Use These Products?

Using the right accounting software can save time, reduce errors, and provide valuable insights into financial performance. Whether you’re a small business owner or a professional accountant, these tools can help you manage your finances more effectively.

Top Accounting Software Options for 2025

- QuickBooks

- Overview: QuickBooks is one of the most widely used accounting software solutions, especially among small businesses. It offers a user-friendly interface and a variety of features that cater to different accounting needs.

- Key Features:

- Invoicing and billing

- Expense tracking

- Payroll management

- Financial reporting

- Pros:

- Easy to use

- Extensive integrations

- Strong customer support

- Cons:

- Can be expensive for larger businesses

- Some features may be overwhelming for beginners

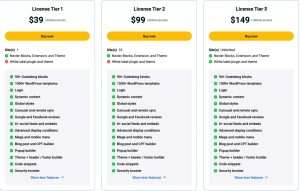

- Pricing:

Plan Monthly Cost Simple Start $25 Essentials $50 Plus $80 - Recommendations For Ideal Users: Best for small to medium-sized businesses looking for comprehensive accounting solutions.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: profitleap.com - Xero

- Overview: Xero is a cloud-based accounting software that is particularly popular among startups and small businesses. Its intuitive design makes it easy to navigate.

- Key Features:

- Bank reconciliation

- Inventory management

- Project tracking

- Multi-currency support

- Pros:

- User-friendly interface

- Excellent customer support

- Strong mobile app

- Cons:

- Limited reporting features

- Can be pricey for larger teams

- Pricing:

Plan Monthly Cost Early $12 Growing $34 Established $65 - Recommendations For Ideal Users: Ideal for small businesses and freelancers who need a straightforward accounting solution.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

:max_bytes(150000):strip_icc()/Accounting-software-4202206-primary-final-cd88d4c4a5cd40c6b848c793a6de496d.png)

Source: www.investopedia.com - FreshBooks

- Overview: FreshBooks is designed for service-based businesses and freelancers. It focuses on invoicing and expense tracking, making it a great choice for those who bill clients for their time.

- Key Features:

- Time tracking

- Client management

- Automated invoicing

- Expense tracking

- Pros:

- Simple and intuitive interface

- Excellent customer service

- Great for invoicing

- Cons:

- Limited accounting features

- Not suitable for larger businesses

- Pricing:

Plan Monthly Cost Lite $15 Plus $25 Premium $50 - Recommendations For Ideal Users: Best for freelancers and small service-based businesses.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: www.milestone.inc - Sage 50cloud

- Overview: Sage 50cloud is a robust accounting solution that combines desktop software with cloud capabilities. It’s suitable for small to medium-sized businesses that require advanced features.

- Key Features:

- Advanced inventory management

- Job costing

- Customizable reporting

- Multi-user access

- Pros:

- Comprehensive features

- Strong reporting capabilities

- Good customer support

- Cons:

- Steeper learning curve

- Higher cost compared to competitors

- Pricing:

Plan Monthly Cost Pro $56 Premium $83 Quantum $150 - Recommendations For Ideal Users: Ideal for businesses that need advanced accounting features and reporting.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: www.accountsiq.com - Wave

- Overview: Wave is a free accounting software that offers essential features for small businesses and freelancers. It’s a great option for those just starting.

- Key Features:

- Invoicing

- Receipt scanning

- Expense tracking

- Financial reporting

- Pros:

- Free to use

- User-friendly interface

- Good for basic accounting needs

- Cons:

- Limited features compared to paid software

- Customer support can be slow

- Pricing:

Plan Monthly Cost Free $0 Payroll $20 - Recommendations For Ideal Users: Best for freelancers and small businesses on a budget.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: smallbusinesshq.co - Zoho Books

- Overview: Zoho Books is part of the Zoho suite of applications and offers a comprehensive accounting solution for small businesses. It integrates well with other Zoho products.

- Key Features:

- Automated workflows

- Time tracking

- Inventory management

- Multi-currency support

- Pros:

- Affordable pricing

- Strong automation features

- Good customer support

- Cons:

- Limited third-party integrations

- Some features may be complex for beginners

- Pricing:

Plan Monthly Cost Basic $15 Standard $40 Professional $60 - Recommendations For Ideal Users: Ideal for small businesses looking for an affordable and comprehensive accounting solution.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: en.wikipedia.org - Microsoft Excel

- Overview: While not traditional accounting software, many accountants use Microsoft Excel for budgeting, forecasting, and data analysis. Its flexibility allows for customized financial models.

- Key Features:

- Data analysis tools

- Pivot tables

- Charting capabilities

- Custom formulas

- Pros:

- Highly customizable

- Widely used and understood

- Excellent for data analysis

- Cons:

- Not designed specifically for accounting

- Higher risk of errors without proper controls

- Pricing:

Plan Monthly Cost Microsoft 365 $6.99 - Recommendations For Ideal Users: Best for accountants who need flexibility and advanced data analysis capabilities.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: profitleap.com - Kashoo

- Overview: Kashoo is a simple accounting software designed for small businesses. It focuses on ease of use and offers essential features for managing finances.

- Key Features:

- Invoicing

- Expense tracking

- Financial reporting

- Multi-currency support

- Pros:

- User-friendly interface

- Affordable pricing

- Good customer support

- Cons:

- Limited features compared to larger software

- Not suitable for complex accounting needs

- Pricing:

Plan Monthly Cost Solo $16 Team $24 - Recommendations For Ideal Users: Ideal for freelancers and small businesses looking for a straightforward accounting solution.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: en.wikipedia.org - AccountEdge

- Overview: AccountEdge is a desktop accounting software that offers a range of features for small businesses. It’s particularly strong in inventory management and payroll.

- Key Features:

- Inventory management

- Payroll processing

- Time billing

- Customizable reporting

- Pros:

- Comprehensive features

- Good for inventory management

- Strong customer support

- Cons:

- Desktop-based, limiting access

- Higher cost compared to cloud solutions

- Pricing:

Plan Monthly Cost Basic $399 - Recommendations For Ideal Users: Best for businesses that require strong inventory management and payroll features.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: informationdock.com - NetSuite

- Overview: NetSuite is a cloud-based ERP solution that includes comprehensive accounting features. It’s suitable for larger businesses that need advanced financial management.

- Key Features:

- Financial management

- Inventory management

- CRM capabilities

- Customizable dashboards

- Pros:

- Comprehensive features

- Strong reporting capabilities

- Scalable for growing businesses

- Cons:

- High cost

- Steeper learning curve

- Pricing:

Plan Monthly Cost Custom Quote Varies - Recommendations For Ideal Users: Ideal for medium to large businesses that require a robust ERP solution.

- Comparison Table:

Feature QuickBooks Xero FreshBooks Invoicing Yes Yes Yes Payroll Yes Yes No Mobile App Yes Yes Yes

Source: www.techysoftwares.com

Challenges and Solutions

Many accountants face challenges such as data entry errors, time-consuming processes, and difficulty in generating reports. Here are some solutions to overcome these challenges:

- Automate Repetitive Tasks: Use software that offers automation features to reduce manual data entry.

- Regular Training: Ensure that all team members are trained on the software to minimize errors.

- Utilize Reporting Tools: Leverage built-in reporting tools to generate insights quickly and accurately.

Tips and Best Practices

- Choose the Right Software: Assess your business needs and choose software that aligns with your goals.

- Stay Updated: Regularly update your software to benefit from new features and security enhancements.

- Backup Data: Always back up your financial data to prevent loss in case of technical issues.

Frequently Asked Questions

What are the benefits of using accounting software?

Using accounting software streamlines financial processes, reduces errors, and provides valuable insights into business performance.

How do I choose the right accounting software?

Consider your business size, budget, and specific needs when selecting accounting software.

Can I use accounting software for tax preparation?

Yes, many accounting software options include features for tax preparation and filing.

Is cloud-based accounting software secure?

Most cloud-based accounting software providers implement strong security measures to protect your data.

What should I do if I encounter issues with my accounting software?

Contact customer support for assistance or consult online resources for troubleshooting tips.

Conclusion

Understanding what software accountants use is essential for anyone looking to improve their financial management skills. From QuickBooks to Xero, each software offers unique features that cater to different needs. By choosing the right tools, you can streamline your accounting processes and gain valuable insights into your financial performance.

Ready to take your accounting skills to the next level? Explore additional resources, subscribe for more insights, or leave a comment below!