In today’s fast-paced business world, managing finances is crucial for the success of any small business. With the rise of technology, many accounting software options are available to streamline processes and improve accuracy. One popular choice for small businesses is offline accounting software. In this comprehensive guide, we will explore the benefits, features, and best options available in 2025 for offline accounting software tailored to small businesses.

Benefits of Offline Accounting Software

Offline accounting software offers several advantages for small businesses looking to manage their finances effectively. Some of the key benefits include:

- Security: Offline accounting software stores data locally on your computer, reducing the risk of data breaches or hacking.

- Accessibility: You can access your financial data anytime, even without an internet connection, ensuring uninterrupted workflow.

- Customization: Offline software allows for more customization and tailored solutions to meet the specific needs of your business.

- Speed: With no reliance on internet connectivity, offline software often operates faster than cloud-based alternatives.

- Cost-Effective: Offline accounting software typically has a one-time purchase fee, making it a more affordable option for small businesses.

Top 5 Offline Accounting Software for Small Business in 2025

1. QuickBooks Desktop Pro

QuickBooks Desktop Pro is a popular choice for small businesses due to its robust features and user-friendly interface. Some pros and cons of QuickBooks Desktop Pro include:

Pros:

- Streamlined invoicing and expense tracking

- Advanced reporting tools

- Integration with Microsoft Excel

- Customizable templates for invoices

Cons:

- Limited scalability for growing businesses

- The steeper learning curve for beginners

- Requires manual updates for tax rates

2. Sage 50cloud Accounting

Sage 50cloud Accounting offers comprehensive accounting features tailored for small businesses. Here are some pros and cons of Sage 50cloud Accounting:

Pros:

- Multi-user access for collaboration

- Inventory and project management tools

- Cloud backup for data security

- Easy integration with Microsoft Office

Cons:

- Higher pricing compared to other options

- Limited mobile access

- Occasional glitches in software updates

3. Xero

Xero is a cloud-based accounting software that also offers an offline mode for users. Some pros and cons of Xero include:

Pros:

- Real-time financial data updates

- User-friendly interface

- Automated bank reconciliation

- Extensive third-party integrations

Cons:

- Limited offline functionality

- Additional costs for add-ons

- Customer support can be slow at times

4. FreshBooks

FreshBooks is known for its simplicity and ease of use, making it a top choice for small businesses. Here are some pros and cons of FreshBooks:

Pros:

- Time tracking and project management tools

- Automated recurring invoices

- Client portal for easy communication

- Excellent customer support

Cons:

- Limited inventory management features

- Lack of advanced reporting tools

- Higher pricing for additional users

5. Wave Accounting

Wave Accounting is a free accounting software option that offers basic features for small businesses. Some pros and cons of Wave Accounting include:

Pros:

- Free to use with no hidden fees

- Easy setup and navigation

- Automatic expense tracking

- Online payment processing

Cons:

- Limited customer support options

- Basic features compared to paid software

- Limited scalability for growing businesses

Frequently Asked Questions about Offline Accounting Software for Small Business

Is offline accounting software secure for small businesses?

- Yes, offline accounting software offers enhanced security measures to protect your financial data from online threats.

Can I access my offline accounting software on multiple devices?

- Most offline accounting software allows installation on multiple devices for seamless access.

Do offline accounting software options offer cloud backup features?

- Some offline accounting software includes cloud backup options for added data security.

Are there limitations to using offline accounting software without an internet connection?

- While offline accounting software operates offline, some features may require internet connectivity for updates or integrations.

How often should I back up my data when using offline accounting software?

- It is recommended to back up your data regularly to prevent loss in case of hardware failure or other issues.

Conclusion

Offline accounting software offers small businesses a reliable and secure way to manage their finances efficiently. By choosing the right software tailored to your business needs, you can streamline processes, improve accuracy, and focus on growing your business. Consider the pros and cons of each option mentioned in this guide to make an informed decision for your small business accounting needs.

Related Posts

- Calculating Total Reach for Email Marketing: A Comprehensive Guide in 2025

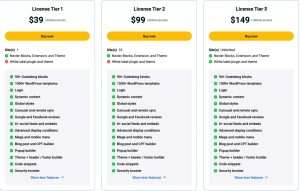

- Pdf-Api.Io Lifetime Deal Review: Best API Tool Analysis in 2025

- Cloudshot Lifetime Deal Review: Unbeatable Features and Value in 2025